Forever is a long time, I know, but according to this study: Policy Options for Integrated Energy and Agricultural Markets by Wallace E. Tyner and Farzad Taheripour at Purdue University – as long as we have ethanol, the price of corn will rise and fall in direct relation to world crude oil prices. Good, bad, or indifferent, this is the face of reality for today’s ag industry.

With the potential of up to 40% of the U.S. corn crop being devoted to the production of ethanol, the authors point out that agricultural and energy markets will be closely linked. The theory is that as the price of oil goes up, the ethanol industry becomes more profitable which leads to more ethanol production. When the industry produces more it increases the demand for corn, which in turn drives up the price of the commodity. It’s essentially a chain reaction with the price of oil as the catalyst.

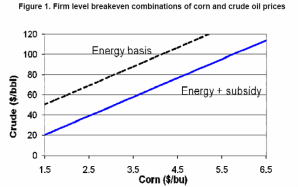

Tyner and Taheripour calculated the profitability of producing ethanol under different combinations of “corn-crude” prices. They illustrate this relationship with the following chart:

As we can see, profitability is calculated with and without the 51 cent blenders subsidy. According to the authors, the addition of the blenders subsidy “adds about $1.60/bu. to the break-even price”. An additional $1.60/bu. is a substantial amount and given today’s market conditions of high oil prices and high grain prices, I look for the 51 cent subsidy to become an increasingly contentious issue. Whether or not we’ll lose the subsidy is open for debate, but as the price of food continues to increase, the voices against the ethanol industry will become louder and the blenders credit will be squarely in their crosshairs.

Beyond the subsidy, the chart gives a clear indication of how high the price of corn could go. It also explains why the price of corn is hovering around the $6.00 mark. The price of crude closed slightly above $116 per barrel in Friday’s trade and looks to be on it’s way to $120 per barrel or higher. If the above chart is correct (so far it’s spot-on accurate), corn prices will move even higher.

At the other end of the spectrum is falling crude oil prices. Under this scenario it’s not hard to envision what the consequences will be. With corn at $6.00/bu. a substantial drop in the price of crude will quickly make the ethanol industry unprofitable, resulting in a lowering of production. Tyner and Taheripour explain the net effect:

…corn price would have to fall because many of the plants would cease production with lower oil prices and high corn prices. That reduced demand for corn for ethanol would, in turn, lead to a drop in corn prices.

The connection with the price of crude oil is unmistakable. For the time being corn and crude are inextricably linked, which is a big change for our industry. Tyner and Taheripour sum it up nicely when they say:

So clearly, we are in a new era – one with a tight long-term connection between crude oil and corn prices. Since this tight linkage will exist between crude oil and corn, we can expect it to exist between crude oil and other agricultural commodities as well.

In the paper, Tyner and Taheripour explore the relationship between corn and crude under differing scenario’s via a computer model. One of the scenario’s they simulate is the elimination of the blender subsidy and in it’s place, a new subsidy tied directly to the price of crude. They use a trigger point of $70.00 per barrel, with ethanol subsidies kicking in if oil falls below that price. Right or wrong, it makes for an interesting policy discussion and may be something that needs to be considered in the future. For further details, be sure to read their paper.